👷♀️build your f-ck layoffs fund👷♀️

Hi friends,

Welcome to Better Have My Money, my Monday(ish) night newsletter about stocks for clueless newbies who are trying to figure out the world of investing in stocks. Better Have My Money is a gif-filled rundown of the stock market, from figuring outwhich investments spark joy for youto thinking about the market like it's a bad boyfriend andhaving a stocks competition with your loved onescause why the hell not.

So the last few weeks have really, really sucked if you work in US media.

I'm a reporter at BuzzFeed News, and recently15% of my colleagues were laid off. Entire verticals were shut down. Watching people who do amazing and important work lose their jobs through no fault of their own sucks a lot. And with cuts also at HuffPost, Vice, McClatchy and Gannett,over 2,000 jobs disappeared in media in just two weeks.

It makes me sad for my friends — where will they find new jobs? — it makes me sad for myself — how can I continue a career in this industry? — and it makes me sad, honestly, for democracy — how the hell are people going to know what is happening in the world?

Like many in the media, I've gone through layoffs before. In fact, it's the exact reason this newsletter exists. As I wrote inthe very first edition of Better Have My Money, published nearly a year ago:

Thanks to a buyout from leaving The Guardian US last year, suddenly I had a few thousand dollars. I opened a high interest savings account with Ally Bank (online only, no fees) and was like 'great, now if I get fired again cause journalism, I will be able to pay rent for a few months.'

Having that buyout money got me into investing and buying stocks because suddenly I had a little bit of extra cash AND a very strong desire to grow it into as much money as I could thanks to a combo of stagnant wages in media and the knowledge that next time it would probably not be my choice to leave my job.

Confusing term of the week: "buyout" — can mean to acquire a controlling stake, aka over 51%, in a business, but in this instance it means when your company offers a severance package to encourage employees to leave the company voluntarily rather than having layoffs.

A great piece in Mel magazine called "The Generation of the Layoff Fund" recently did the rounds again:

The grim job reaper returned in June, after exactly one year at my new job.

This time, however, I was prepared. Admittedly, my layoff fund wasn’t substantial — I had about $5,000 in the bank — but it gave me a level of material and psychological security I wouldn’t have otherwise had. It’s similar to Paulette Perhach’s “fuck off fund,” but instead of hoarding away my extra cash so I could use it to get away from an abusive boyfriend or a toxic job, I saved with the knowledge that someday, my job would tell me to fuck off. Similarly, it’s more purposeful than a vague, nonspecific emergency fund; it’s a way of preparing for a shitty situation that increasingly seems inescapable.

That "material and psychological security" is no joke. The first thing I did when we heard the news of layoffs was start franticly checking and tallying my bank accounts . As crappy as it was to go through layoffs in the workplace again, I was less terrified because I knew financially I would be OK.

The basic guideline of any kind of emergency fund is to have at least three months, preferably six months, worth of living expenses in a high interest savings account that you can easily access.

I have deliberately chosen to build investments at the same time as an emergency fund, so I have a little less than three months in cash savings, but I'm working towards it every pay cycle.

I then also have a similar amount in investments — because I want to actively grow that money, but there's a clear downside in that. You don't want to have to sell your shares at a time when you're desperate, because that might not be when the market is going well.

For me, the mix of cash I can easily access, shares I can sell if needed (but would prefer not to) and other investments that I can't instantly access but are growing slowly in the background meant one less thing to worry about in a stressful period.

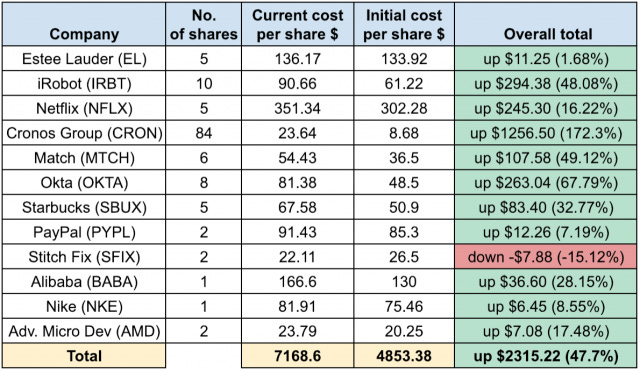

And weirdly in the last week, my stocks have been rising like crazy. My weed stocks Cronos are now up 172%, which.... feels bonkers and unsustainable, but nice. I keep wondering when I will sell some of them so that I can make a little bit and diversify more, because I want this layoff fund to grow and grow. Currently I'm up 47% overall, in one year.

Again, definitely not sustainable and surely going to head down again soon but a little bit of unpredictability feels just like my career, so I'm OK with that.

Testimonials: From Natalie Daher via Twitter: "The Kondo/stocks angle in @bhavemymoney’s newsletter is a delight, and I highly rec for anyone trying to get that *money bag emoji* in 2019"

For this week's charity of the week, can you just subscribe to your local newspaper, radio station or favorite publication? Give news organizations your money otherwise we're all fucked.

Cheers,

Amber Jamieson

Better Have My Money is on Twitter @bhavemymoney, so please tweet nice things (aka the link to our sign up page) and tag us. Got a mate who also likes weed? Forward this onto them and tell them to subscribe.

As always, if you've got any questions about stocks, this is a shame free zone. Just reply and ask away.