🏎️let the Money Games begin 🏎️

Hi friends!

We've just made it through the first week of 2019, well done us. Welcome back to Better Have My Money, my Monday night newsletter about stocks for newbies who are trying to figure out the world of investing in stocks. Look yes, I've been MIA thanks to my toddler nephew visiting and then holidays, we're now returning to weekly programing.

Better Have My Money is a gif-filled rundown of the stock market, fromapps that help you invest without thinking about it, to thinking about the market like it's a bad boyfriend andchilling out when finance news seems scary.

Resolutions — whether they're hyper specific or vague af — can be a good way of figuring out how you want to invest your dough this year. They can be stressful to think about, particularlyafter reading about how burned out millenialsaka me, myself and I are, but what are your 2019 investment resolutions? Start investing in the stock market? Take bigger risks? Cash in and do something else with the money? Make a certain amount of moolah?

The reason this newsletter exists is because my 2018 resolution was to get better at money.

I decided to use some of my small pile of savings and buy about $2000 worth stocks in Jan 2018. Instantly I was hooked on the thrill of choosing which companies I thought would be good investments and then sitting back and watching them grow (and drop, and then grow and then drop and then drop and then grow). I started this newsletter Feb 2018, nearly a year I'm still writing it, and I've now got over $6000 invested in stocks.

Honestly didn't realize until writing this now how successful that resolution ended up being?

This year my main resolution is to host a monthly dinner party — investing in my friendships and building community — but one of my other resolutions is to havea mini stocks competitionwith my boyfriend. Yes, a competition!

I'm calling it Money Games 2019.

We've both allocated $250 to invest in stocks. We blatantly stole this idea from friends and kept it very simple: You could spend the whole $250 on one stock or spread it across a bunch of companies. The idea is that we'll check in every few months to see who is winning. Winners get the glory and maybe the loser buys dinner? Still tbd.

I'd been trying to encourage like a $500 or $1000 competition, he was less excited about that (I also don't have that much money so honestly good thing he flat out refused my high rolling games).

It's been five days and we've already checked in several times, but that's because I got excited. And I'm already winning! I'm up $13!

So far I've bought one stock in Alibaba (BABA), the huge Chinese online store often compared to Amazon, at $130. My boyfriend bought one stock in Apple when it was down at $142 last week. He has never bought any stocks before this, minus about $20 in MoviePass last year when it had collapsed (I'm pretty sure that $20 is worth about $5 now). So this is a good way of him dipping his toes into stocks land.

I've only got another $120 I can spend so I'm trying to figure out how to divvy it up: maybe a Nike (NIKE) stock? More Starbucks (SBUX)? Some JetBlue (JBLU)? Advanced Micro Devices (AMD), which makes computer chips and everyone is obsessed with. I could also grab two Square (SQ) stocks, since they're currently $60 each. Any suggestions?

I'm not claiming having a stock competition is some great long-term strategy for investing, but if money isn't also fun then what the hell is the point.

You could do with a partner, your best mate, a group of friends, your two maids, your queen, your mother, really just bloody anyone so that it's something you can have fun with and start conversations about investing and reading about companies and paying attention to the news.

Also, my regular reminder that if you open a Robinhood account, which lets you buy and sell stocks with zero fees so is good for this kind of game, use my referral code and we both get a free share.

I read a piece at The Outline today about how the Robinhood app "is a very nice looking way to go broke." The article has some decent points about how investing can be like gambling, particularly when it's so easy to do on an app like that.

The writer is mad at how easy it is for him to do options trading on the app without knowing what he was doing which OK, but also... isn't it brilliant that it's easy for people to have access to stuff like this?

Confusing term of the week: "options trading" — I've tried reading about this but I'm still confused but essentially buying options gives you the right to buy stocks at a specific price, but doesn't obligate you to do so. It seems to be all about speculating on whether a stock will go up or down in the future, obviously I'm not about to start options trading, and I do not recommend this for Money Games 2019.

If you're dumb enough just to randomly spend your money on things without learning first about what you're doing then hey, my venmo is @amber-jamieson, transfer me $5 right now!

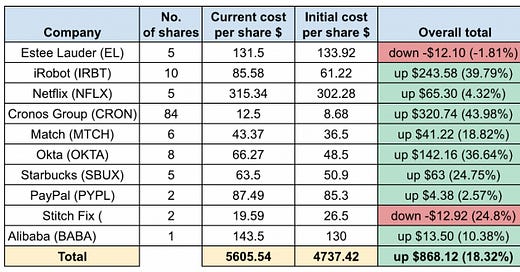

I haven't done a roundup of my stocks for a while, here's where I'm at. After the huge drops at Christmas time and last week I wasn't expecting that I'd be up so decently overall, nice surprise.

Testimonials

From reader Kaela via email: "Your newsletter is the highlight of my Tuesday morning commute — thanks for breaking everything down in a way that doesn't make me feel like an idiot while also teaching me enough that I can follow (and sometimes even join!) a conversation with some of my finance bro friends at happy hour (🙌)" — Kaela, this was very kind, also plz squish all the finance bros like bugs with your stocks chat.

Hit reply and tell me about your own Money Games 2019 and what you're playing.

Cheers,

Amber Jamieson

Better Have My Money is on Twitter @bhavemymoney, so please tweet nice things (aka the link to our sign up page) and tag us. Got a mate who has a resolution to make more bank? Forward this onto them and tell them to subscribe.

As always, if you've got any questions about stocks, this is a shame free zone. Just reply and ask away.